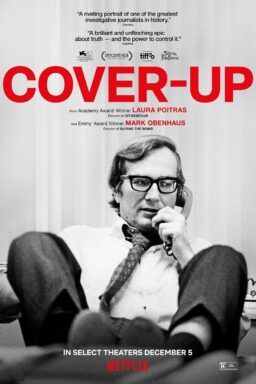

The numbers are unimaginable. The vocabulary is mind-numbing—and intended to be so. One of the biggest financial scandals of all time is known as the Panama Papers, a global money laundering/tax evasion/corruption-concealing scheme involving some of the world’s wealthiest and most powerful people, including politicians and crooks. They hid their money in what are called “shell” corporations. The interlocking network of these companies was revealed with the help of a still-undisclosed whistleblower thanks to the tireless work of a group of non-profit journalists who had to comb through millions of arcane legal documents to understand and explain it all.

Great story. But unlike a simple straightforward fraud like the Bernie Madoff Ponzi scheme, which was depicted in two different film versions starring Oscar winners Robert De Niro and Richard Dreyfuss, the Panama Papers mess was so big and complicated it seemed almost impossible to put into dramatic form. That was the challenge faced by journalist Jake Bernstein, who wrote the sober, meticulously detailed book, and screenwriter Scott Z. Burns (“The Bourne Ultimatum“), who wrote the colorful, funny, and dramatic movie. In an interview with RogerEbert.com, Bernstein and Burns talked about finding the right characters and tone to make this story as entertaining as the real-life case was impactful.

When you start to translate this immensely complicated story into an accessible, engrossing film, where do you begin?

SCOTT Z. BURNS: It was fun. I was inspired by the movie “Wild Tales,” the tone of it and the way it was an anthology of different stories. When Jake and I began going back and forth about this, there were hundreds of thousands of shell corporations. Each one of them is a different story and some of those stories are pretty diabolical. Some of them are fairly innocuous. Because my research kind of corresponded with his research. I had an excellent teacher, how this whole world works. I realized pretty early on that the language is as inscrutable as it is, surrounding this world because they don’t want people to understand. That is true in law or medicine but certainly more with banking. Anything where there are these codified bodies of knowledge. It’s designed to be impenetrable for the everyman.

That to me became as important as the details because to me what is so exclusionary and diabolical about this is that our money, the money that might go to the public good is being squirreled away. We do not understand how or why or where.

Jake, how was thinking about this story for the movie different than the way you approached the book?

JAKE BERNSTEIN: I had spent a year as a senior reporter on the project for the International Consortium of Investigative Journalists, which is a global network of more than 200 investigative journalists in 70 countries. Really going into the data and working specifically on Russia, but on other stories too. By the end of the project, though, there were a couple things that were question marks for me.

One was we never really got the perspective of [the two lawyers who were at the heart of the fraudulent companies], Ramon Fonseca and Jürgen Mossack [played in the film by Antonio Banderas and Gary Oldman]. I wanted that. I wanted to know what it was like from their perspective, to have this huge leak fall on top of them and destroy them, and also know just what their business was.

Then the other thing was we had 40 years of data. You could use that data to really tell the story of the evolution of the offshore system. I was really excited about doing that, and what’s so great about the movie I think is that you have these incredibly charismatic guys, Gary and Antonio to take us through the story and tie it together. They are your guides to this world; they’re telling you how this world functions in a similar way to what I saw the papers doing in my own book. I thought that that was magnificent.

What is so great about the movie, though, is it really it doesn’t really focus on them in the sense that they are the only ones to blame. As soon as they’re gone, there are lots of people who will take their place. It is about a system. It is a problematic system; it’s not really two individuals.

SB: I mean, with Jake’s help I was actually able to speak to them both. Ramon is a really fun guy to talk to about this stuff. I feel a lot of what he said to me when we spoke is in there. I understand from their perspective everyone who they ended up opening a company for had spoken to a banker, and a lawyer and to completely dump this on them is not going to get the problem solved.

The film is not just divided into different stories, but there are rules that serve as chapter titles and that let us know what each of the stories is illustrating.

JB: As Scott was saying, what was wonderful is that they knew they were going do this anthology approach, and so they needed different stories. I literally gave them a menu—you could have something from Russia over here, you could have something from Africa over there—a bunch of different options.

I was writing about all of them and trying to figure out what ones I was going to focus on to be illustrative in my own book. We just sort of had a lot of back-and-forth about, Scott would be like, “Tell me more about this, I want to dive deeper into that.” Then there is this brilliant decision of theirs from the outset to make it a comedy. To accent the humor was so great because there’s not a huge amount of humor in my book, although some of it is really darkly funny, like the poor woman who dies and it is a huge problem because she is the signatory to literally tens of thousands of companies. That is true. It is in my book. In a way, it is farce, to have this very complicated financial structure that was designed to protect powerful people almost brought down because a low-level woman suddenly died.

SZB: The fact that there are people signing their names on blank pieces of paper that would later be filled in is so absurd. It’s like something out of Catch-22. [Director] Steven Soderbergh and I are both drawn to Kafkaesque absurdist humor. He and I decided a couple of years ago that the only way to handle a subject like this in our society right now is to make it funny. Because it turns into vitamins otherwise.

JB: Or it’s soul crushing. Humor helps you understand it and makes you want to understand it.

Part of what makes this so difficult is that it is abuse of structures that were set up for the right reasons. People do have a legitimate interest in privacy. Particularly very wealthy people and people in the public eye have a legitimate interest in privacy. How do you create something that is suitable for their legitimate interest without turning it into something that then can be used for all kinds of nefarious purposes?

JB: You are absolutely right, and it’s something that I tried to put in my book. I think it is in the movie in a way, too. There are people who are worried about kidnapping in, say, Argentina. People might know they are rich but they don’t know the extent of their assets or what they are. Another example is someone told me about a gay couple in Panama. They would like to buy an apartment together but this is a society that frowns on that. They need some anonymity to be able to do that. This is a system that desperately needs more transparency but I think that the question of how much transparency is one that is not necessarily cut and dry.

I think that at the very limit there should be automatic information exchange between governments. We should know if there are Americans who are using Swiss banks to avoid paying taxes. It should be going on with the British Virgin Islands, in the Caymans, everywhere else.

The other thing is that, this is sort of a subterranean superhighway of money, and really what keeps it open are corporations. There are trillions of dollars that corporations are keeping offshore and so we need to go after the big fish. In the Bahamas or Bermuda there are corporations that are booking like 50 times what the GDP of a tiny island is. It’s ridiculous. Everyone knows that it’s ridiculous, so I think that’s one place where we can reform, and we don’t have to step on anyone’s privacy.

You had a better explanation of the Delaware problem in the movie than I got in law school. The second-smallest state makes an enormous amount of money by making it easy to set up a corporation there and giving corporations domiciled there the benefit of extremely protective laws. The former Chairman of the SEC called it the “race to the bottom.” Now, as your movie shows us, that same problem is at a global scale.

JB: It is a billion dollars a year, that corporate registry pulls in. What is so wild is that the Treasury Department and State have been complaining for years that Delaware companies are being used by transnational gangs, by money launderers, and things like that. All that would require for Delaware is you would have to collect a little bit more information. You have to make the people who are creating the companies.

SZB: One of the things that was really interesting to me when I started talking to Jake about this, that I think is understandable for the layperson, is the difference between privacy and secrecy. I think that due diligence can be done in a way that is respectful of people’s privacy. Can reveal wrongdoing. What is so stunning to me about the John Doe manifesto is the solution really is ending secret campaign contributions. Because if we believed that the people who were in charge of oversight were impartial. I know I would feel much more comfortable going okay there are regulatory bodies, there are people who will look into this, you are not going to play favorites.

JB: And who will protect the anonymity.

SZB: I get to live in an idealized movie or a world of a screenwriter. But the race to the bottom, if we go down that path, we’re going down a path where we’re going to say that bribing people is okay, and that’s a very short walk to, “Okay, well I do not want to pay my fair share in terms of taxes into a opaque and probably corrupt system.” But people flock the United States for the rule of law, intellectual capital, and transparency or all those things we do better than other countries. I mean you’ve got to play to your strengths, and say those are the kind of companies we want. This is what we are going to be doing in the long term that will bring greater shareholder value.

When journalists get a data dump like this, what happens next?

JB: It unspooled over time. It came in over time and our eyes got wider and wider. For one thing, they had, I think, 11 Amazon servers doing the optical character recognition on these documents so we could search them. It was like a ballet of servers running through all these documents, and then they created this multi password-protected sort of Facebook for us to all gather in as we were going through, it and share our findings and communicate.

So, that really is the happy ending, isn’t it? All of these systems were set up for privacy, yet all it took was presumably one person to blow it open.

SZB: The truth will out eventually.